ev charger tax credit 2020

How long is the US federal tax credit for EV chargers good for. You must have purchased it.

Nissan Leaf Electic Car Features Car Charging Stations Nissan Leaf Electric Car Charging

As it currently stands the credit will apply to any EV charging installation work through December 31.

. Consumers who purchase qualified residential fueling equipment prior to December 31 2021 may receive a tax credit of up to 1000. The important thing is not to overlook incentives for buying the EV charging station which is a critical component of a convenient and enjoyable EV ownership experience. For tax years beginning before January 1 2020 a tax credit is available for up to 75 of the cost of installing commercial alternative fueling infrastructure.

This incentive covers 30 of the cost with a maximum credit of up to 1000. Fueling station owners who install qualified equipment at multiple sites are allowed to use the credit towards each location. Eligible alternative fuels include natural gas propane and electricity.

The EV Charging Station tax credit was extended at the end of 2019 for chargers installed from 2018-2020. Then from October 2019 to March 2020 the credit drops to 1875. To qualify for the Charge Ahead Rebate the purchaser or lessee must be from a low- or moderate-income household.

421 rows Federal Tax Credit Up To 7500. EV charging infrastructure rebates available in New Jersey. The new bill would look to reinstate up to 7000 in tax credits for these EVs.

Use this form to figure your credit for alternative fuel vehicle refueling property you. Just buy and install by December 31 2021 then claim the credit on your federal tax return. Form 8911 has already been released by the IRS but the expected TurboTax release date is 2-20-20.

Alternative Fuel Infrastructure Operator. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Nissan is expected to be the third manufacturer to hit the limit but.

Earned Income Tax Credit. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours.

29 2019 or later also qualify for this rebate. 2500 for EVs and 1500 for hybrids. It covers 30 of the costs with a maximum 1000.

Grab IRS form 8911 or use our handy guide to get your credit. The Alternative Fuel Vehicle Refueling Property Tax Credit or 2020 30C Tax Credit provides tax relief for businesses that install refueling properties such as EV charging stations and applies retroactively to any costs associated with. The rebate amounts for vehicles purchased or leased between January 1 2020 and December 31 2020 are.

Businesses and Self Employed. Federal EV Charger Incentives. This tax credit helps subsidize the installation costs of residential charging and commercial charging stations.

Tax Incentives Registration or Licensing Fuel Taxes Loans and Leases Fuel Production or Quality Rebates Renewable Fuel Standard or Mandate. Electric Vehicle Tax Credit. From April 2019 qualifying vehicles are only worth 3750 in tax credits.

You may be eligible for a credit under Section 30D a if you purchased a car or truck with at least four wheels and a gross vehicle weight of less than 14000 pounds that draws energy from a battery with at least 4 kilowatt hours and that may be recharged from an external source. It is not yet known if this credit will be extended for any chargers installed in 2022. Central Iowa Power Cooperative CIPCO residential customers are eligible for a 500 rebate on the purchase or lease of a plug-in electric or plug-in hybrid electric vehicle.

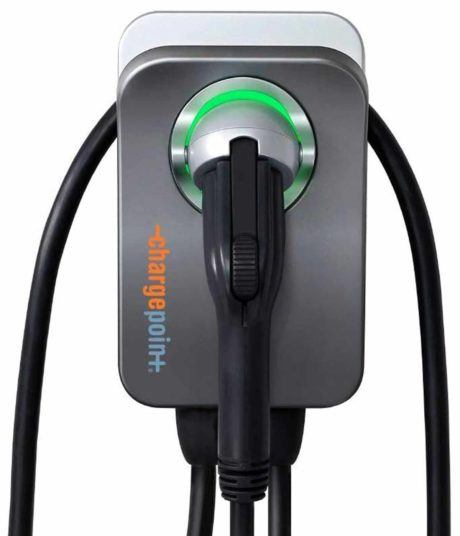

You might have heard that the federal tax credit for EV charging stations was reintroduced recently. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. The AFITC is a time-limited EV charging tax credit.

Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate. It already expired once in 2016 but was extended by the government through December 31 2020. State andor local incentives may also apply.

Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. State tax credit equal to the lesser of 35 of. Up to 1000 Back for Home Charging.

January 1 2023 to December 31 2023. The credit for the charging station in a nonrefundable credit. The credit amount will vary based on the capacity of the battery used to power the vehicle.

Ad Get up to 150000 per DC fast charger to install EV charging stations in New Jersey. If youre thinking about buying an electric vehicle EV the federal tax credit can save you a lot money. 2020 to December 31 2022.

The AFITC Is Expiring at the End of 2020. Heres how to claim your credit for 30 of the cost of your home charger and installation up to 1000. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Beginning on January 1 2021. Plug-in hybrid electric vehicles purchased on Sept.

Personal Vehicle Owner or Driver. Hopefully this does not become a fiasco like Form 8936 and the staff. Permitting and inspection fees are not included in covered expenses.

The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit. Apply today with FLO. Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive.

After that the credit phases out completely. It is on the IRS site Browse Discuss. The full phase-out already occurred for GMs Chevrolet Bolt Volt and Cadillac CT6 Plug-in and ELR for example with these EVs becoming ineligible for the credit after the end of March 2020.

Where is the new form 8911. To receive the federal tax credit for installing an EV charger in your home you must purchase and install the charger by December 31 2021. Everything You Need to Know.

A non-refundable tax credit is a tax credit that can only reduce a taxpayers liability to zeroThe credit cant be used to increase your tax refund or to create a tax refund when you wouldnt have already had one. Carpool lane access and reduced rates for electric vehicle charging. Right-to-Charge Other Incentive Other Regulation User All.

EV charging stations purchased in 2018 through the end of 2020 are now eligible for a 30 tax credit for purchase and installation costs up to 1000 dollars for residential installations and up to 30000 for commercial installations.

Ev Charging Stations Provide Key Business Benefits Powering Chicago

Mrsc Local Governments Take Innovative Approaches To Prepare For Electric Vehicles

Best Home Ev Chargers 2020 Vs Ford Connected Charge Evse Mach E Forum Ford Mustang Mach E Forum And News

Home Electric Car Chargers Ev Charging Stations Evse

Cost Of Charging An Electric Car Electric Vehicle Savings

Infrastructure Plan Calls For 500 000 New Charging Stations Let S Not Screw It Up Like The First 80 000

Reserved A Cybertruck As A Leader In Sustainability We Are Really Excited Will Have To Install An Ev Charger At T Ev Charger Green Energy Renewable Energy

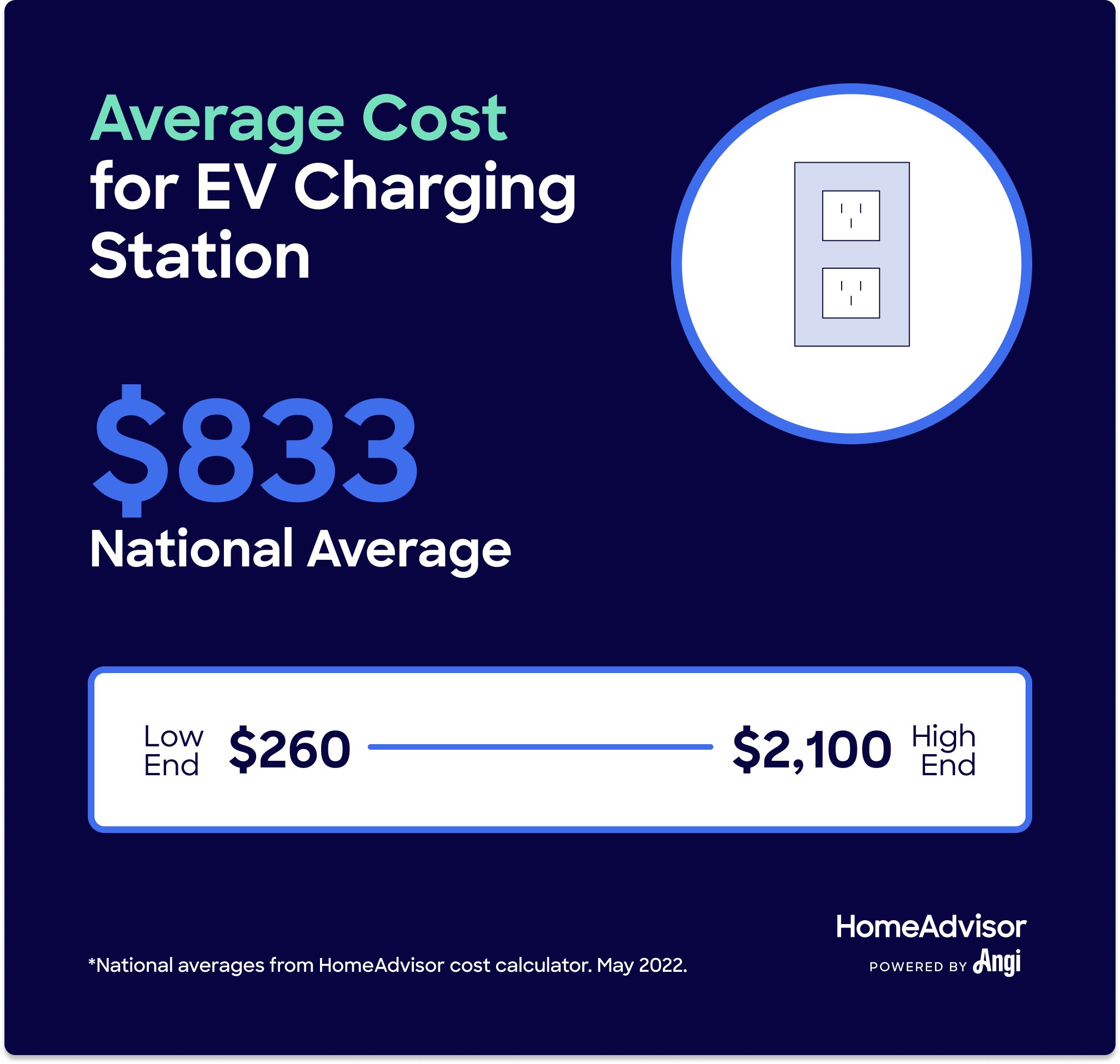

How Much Does It Cost To Install An Ev Charging Station

How Ev Charging Stations Can Benefit Your Workplace

Home Electric Car Chargers Ev Charging Stations Evse

Ev Charging Speeds Charging Levels And Charging Stations What S The Difference Smart Electric Vehicle Ev Charging Stations

How Much Does It Cost To Install An Ev Charging Station

The Ev Transition How Electric Car Uptake Has Grown In Australia

Hyundai Kona Electric Hyundaiusa Com Hyundai Electric Car Hyundai Electricity

New Ev Charging Station In Sanford Florida Zapfchen Saulen

Home Electric Car Chargers Ev Charging Stations Evse